G8 Schooling Limited (ASX:GEM), is not the largest firm out there, but it saw a respectable share cost development in the teens degree on the ASX above the previous handful of months. With quite a few analysts masking the stock, we may well be expecting any selling price-sensitive announcements have already been factored into the stock’s share rate. But what if there is however an chance to obtain? Right now I will analyse the most new info on G8 Education’s outlook and valuation to see if the option still exists.

Look at our most recent evaluation for G8 Education and learning

What is actually the chance in G8 Instruction?

The stock would seem relatively valued at the second in accordance to my valuation model. It is buying and selling close to 3.% under my intrinsic value, which suggests if you acquire G8 Training these days, you’d be paying out a good price for it. And if you imagine the company’s true price is A$1.20, then there’s not much of an upside to obtain from mispricing. While, there may perhaps be an option to obtain in the foreseeable future. This is due to the fact G8 Education’s beta (a measure of share rate volatility) is substantial, that means its value movements will be exaggerated relative to the rest of the industry. If the marketplace is bearish, the company’s shares will likely slide by far more than the relaxation of the market, offering a primary getting chance.

What does the long term of G8 Schooling search like?

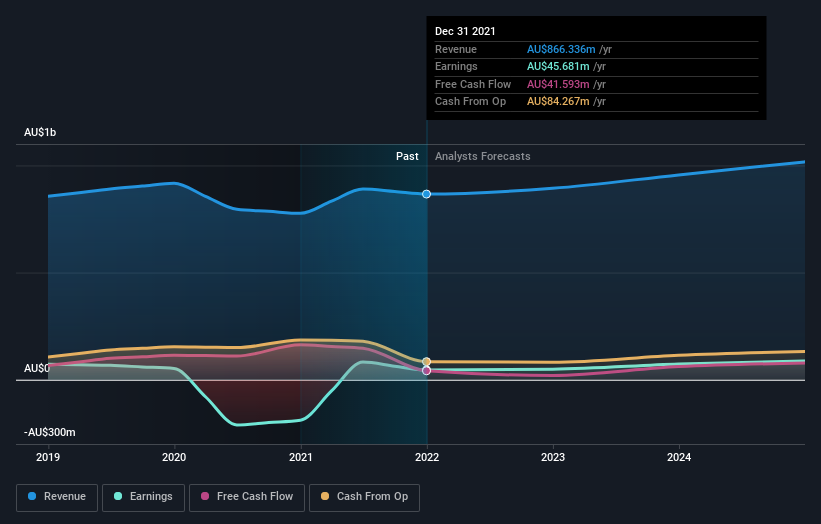

Potential outlook is an essential part when you’re seeking at buying a stock, especially if you are an trader on the lookout for growth in your portfolio. Shopping for a terrific firm with a sturdy outlook at a low-cost price is always a fantastic investment, so let’s also consider a glance at the company’s upcoming anticipations. G8 Education’s earnings around the next handful of yrs are envisioned to increase by 92%, indicating a remarkably optimistic potential forward. This must lead to more robust money flows, feeding into a increased share worth.

What this usually means for you:

Are you a shareholder? It looks like the current market has by now priced in GEM’s optimistic outlook, with shares buying and selling all around its honest worth. Even so, there are also other vital aspects which we have not considered right now, this kind of as the financial toughness of the business. Have these aspects modified due to the fact the last time you seemed at the inventory? Will you have adequate self esteem to make investments in the corporation should really the value fall beneath its truthful worth?

Are you a likely investor? If you’ve been holding tabs on GEM, now might not be the most advantageous time to get, specified it is buying and selling all-around its good price. Having said that, the good outlook is encouraging for the enterprise, which implies it’s truly worth even more inspecting other elements these kinds of as the strength of its balance sheet, in get to get advantage of the following price tag fall.

If you want to dive further into G8 Instruction, you’d also search into what threats it is currently going through. For instance – G8 Education has 1 warning sign we feel you should be knowledgeable of.

If you are no lengthier interested in G8 Training, you can use our no cost platform to see our record of about 50 other stocks with a higher progress prospective.

Have suggestions on this short article? Anxious about the articles? Get in touch with us directly. Alternatively, email editorial-workforce (at) simplywallst.com.

This posting by Only Wall St is normal in character. We give commentary dependent on historical knowledge and analyst forecasts only utilizing an impartial methodology and our article content are not meant to be economic suggestions. It does not constitute a advice to buy or provide any stock, and does not get account of your objectives, or your fiscal predicament. We purpose to convey you prolonged-term targeted investigation pushed by essential details. Take note that our examination may possibly not element in the most recent value-sensitive organization announcements or qualitative substance. Basically Wall St has no situation in any stocks outlined.