solarseven/iStock via Getty Images

Thesis

The 10-year yield curve crossed the 2-year yield curve for the first time since 2019, which often indicates a warning of recession risk. An economic recession may not come right away, but as investors, we have to get prepared before it does.

The fundamentals of Thermo Fisher Scientific Inc. (NYSE:TMO) are strong, and the company‘s future is promising. Also, the life science tools and services company exhibited its current financial strength and recession-proof ability in the previous bear market. With a great balance between growth and recession-proof ability, TMO is the choice in the healthcare sector.

Robust Growth

The previous financial results of TMO are solid. From 2017 to 2021, the company’s revenue per share grew at a 16.5% CAGR, and earnings per share surged by 30.76% CAGR. Margins, return on equity (ROE) and return on invested capital (ROIC) also expanded during the period. The table below shows some strong sales and earnings data reflecting the company‘s profitability over the past five years.

|

2017 |

2018 |

2019 |

2020 |

2021 |

CAGR (2017-2021) |

|

|

Revenue per share (YoY%) |

14.47 |

16.45 |

4.86 |

26.14 |

21.71 |

16.50 |

|

Earnings per Share (YoY%) |

9.82 |

29.52 |

26.66 |

74.05 |

21.93 |

30.76 |

|

EBITDA per Share (YoY%) |

12.70 |

15.26 |

17.43 |

25.33 |

30.15 |

20.00 |

|

Gross Margin (%) |

45.2 |

44.6 |

44.4 |

49.7 |

50.1 |

– |

|

Operating Margin (%) |

14.7 |

15.7 |

16.4 |

24.5 |

26.1 |

– |

|

ROE (%) |

9.48 |

11.09 |

12.91 |

19.87 |

20.52 |

– |

|

ROIC (%) |

6.02 |

6.82 |

7.49 |

13.43 |

13.28 |

– |

The stock‘s top-line and bottom-line boosted in 2020 and 2021, which benefited from Covid-related sales. In 2021, COVID-related products contributed 23% of the company‘s total sales. It is doubtful that the demand for COVID-related products will decrease when the pandemic is shifting into an epidemic. I will cover this in the latter part of the article.

Future Potential

Covid-related Revenue May Stay

The Biden-Harris administration released the 2023 Budget in late March, where pandemic preparedness becomes one of the focuses. The $88.2 billion Budget for pandemic preparedness invests in developing vaccine production technology, next-generation PPE, more effective and affordable diagnostics, pathogen detection technologies, etc. With the U.S. Government anticipating fighting COVID-19 variants and preparing for the next pandemic, TMO definitely could play a vital role in it. From the start of the COVID-19 pandemic, the company has already been playing a leading role in the industry by developing one of the first PCR test kits and vaccine tests for COVID-19, demonstrating TMO’s ability and leading status in diagnostics and vaccine production technology. TMO’s interest in the expanding budget on pandemic preparedness could be huge. I look forward to the possibility that TMO could collaborate with the U.S. Government in providing instruments and consumables used in biological and medical research for more effective and affordable diagnostics.

As the COVID-19 variants keep evolving, it seems that COVID-19 will become an epidemic. The latest variant dominating in the U.S. now is Omicron BA.2. Health experts reported this variant would be unlikely to result in a spike in the U.S., and the severity of the variant remains low. However, booster shots are still considered necessary for adults aged over 50, and new vaccines to tackle Omicron are still under development. I believe the demand for COVID-19 test kits and vaccines will become long-lasting.

Besides, the company entered a $192.5 million contract with the U.S. Department of Defense to increase the capacity of COVID-19 testing last September and teamed up with Moderna (MRNA) recently for a 15-year strategic collaboration agreement. The latter enables dedicated large-scale manufacturing in the U.S. of Spikevax, Moderna‘s COVID-19 vaccine, and other investigational mRNA medicines in its pipeline. If mRNA technology becomes an important player in flu or flu-Covid vaccines in the future, the demand for vaccine production using mRNA would be unlikely to drop. TMO would be benefited from it as they could use the same production line manufacturing Spikevax to produce the vaccine.

Pharma and Biotech Market keeps expanding

The company enjoyed good growth in the pharma and biotech market. Over the past two years, the market enjoyed 20% plus growth. As the largest market of the company in terms of sales, it contributes 42% to the company‘s sales in FY 2021. The company expected the market to further grow to $20 billion in the coming year, from $18.9 billion in FY2021. There is a good level of investment supporting academic research in the pharma and biotech industry in the post-pandemic era, as people started acknowledging the importance of understanding diseases. With research activities becoming more active, TMO found robust growth in relevant tools and technologies.

The acquisition of PPD last year helps TMO to gain market share and expand the company‘s global reach in the clinical and research services to the pharma and biotech industries. TMO would also benefit from the synergy of the acquisition. If the company handles both clinical trials and the production of a new drug, it could be manufactured in scale within the shortest possible time. Time is of the essence to the pharma industry, and we all know this after COVID-19. Besides, it is expected that the acquisition would bring an extra $1.50 in earnings per share in FY2022 and create synergies of about $125 million by year three following the close of the deal.

There are also emerging sectors within the pharma and biotech market. Precision medicine and gene sequencing is gaining popularity right now. ARK Invest expects the Gene Sequencing market will grow to $1.6T in 2030. For now, TMO provides services on “targeted sequencing solutions for research application of Next-Generation Sequencing in oncology and companion diagnostics” and collaborates with various leading universities and clinics on precision medicines and diagnostics. With the expected explosiveness in this market, the demand for services for the sector may also grow exponentially.

The company is expected to continue to grow in 2022, with revenue and EPS up by 7.5% and 15.26% respectively.

Recession-Proof Ability

I found TMO less volatile in the previous bear market than the benchmarks. S&P 500 Index (SPY) and SPDR Select Sector Fund – Health Care (XLV) dropped 35.33% and 29.22% respectively from 20 Feb 2020 to 23 Mar 2020, while TMO pulled back 26.70% within the same period. I think the stock could outperform the S&P 500 Index in case a bear market hits again.

Apart from TMO‘s leading position in the industry that would secure the demand for its product, its current financial strength is also solid. Despite long-term debt doubling from $17,076M in FY 2019 to $32,333M in FY 2021, the debt-to-equity ratio still maintains under 1. I believe it is a sensible move for the company to make more borrowings in the low interest rate environment, cutting future interest rate payments. And at the same time, it provides cash for the company‘s expansion and operation at a lower cost.

The free cash flow of TMO has also grown by 14.2% CAGR over the past five years, reported at $6,789M in FY 2021. Free cash flow is key when the Fed kicked off the rate hike cycle. With ample cash on hand, the company would have a lower chance to face difficulty in searching for cash to operate and paying off debt during a recession.

Challenges Ahead

I found multiple headwinds that TMO may face in the rest of 2022, which are the disruption caused by the war in Ukraine and the recent lockdown in China.

Despite the company reflecting the sales from Russia and Ukraine as insignificant, it shows its worry about the supply chain issue, which leads to surging transport costs and delays in delivery. With a high probability, the supply chain issue sees no signs of easing in 2022 due to geopolitical tensions, the resurgence of COVID-19 in China, labor shortages, and so on. Fortunately, TMO can pass through pricing responsibly with their customers, which alleviates the adverse impact.

As I mentioned, the PPD acquisition is accountable for an extra $1.50 in earnings per share in FY2022. But the goal may be unachievable as Ukraine and Russia are accountable for about 10% of clinical studies for U.S. pharma companies. Also, PPD has outsourced the services to perform clinical research in Ukraine. Companies like Merck (MRK) are now unable to deliver the medicines to the patient and halted the clinical trials. PPD also has a high probability of facing similar hardships.

Apart from the war in Ukraine, the recent development of Covid in China is also worth noting. TMO had a remarkable 2021 in the China market, which grew close to 20%. The Chinese Government is still adopting the Zero-Covid strategy. The recent lockdown in Shanghai showed a complete interruption to economic activities. With the rapid spread of Omicron, it is not surprising that more cities will be in lockdown. While the China market is currently accountable for 8% of the total sales, the potential lockdown will do some damage to the company’s revenue and slow down the growth projection.

Valuation

I will use P/E Ratio to demonstrate the valuation since TMO has delivered constant and predictable earnings results over the past five years. FY2020 is quite the exception as the company benefits from COVID. Below recaps the EPS YoY% from 2017 to 2021.

|

2017 |

2018 |

2019 |

2020 |

2021 |

|

|

Earnings per Share (YoY%) |

9.82 |

29.52 |

26.66 |

74.05 |

21.93 |

CAGR (2017-2019 & 2021) is 21.74%, while the company‘s estimate on EPS growth in the coming fiscal year is 15.26%; with TMO‘s current P/E ratio at 31.29, such that its forward P/E ratio would be 26.52 (lower growth target) and 24.49 (higher growth target).

Compared with the sector‘s median and TMO‘s five-year Forward P/E average, the stock is now with an upside space of 6.9% to 28.79% over a twelve-month period. Meanwhile, the current PEG ratio of the stock is 1.33, which points to a reasonable valuation of the stock at the current moment.

|

(Data abstracted from Seeking Alpha) |

Forward P/E Ratio |

|

Sector Median |

28.35 |

|

TMO Five-year Average |

31.54 |

Technical Analysis

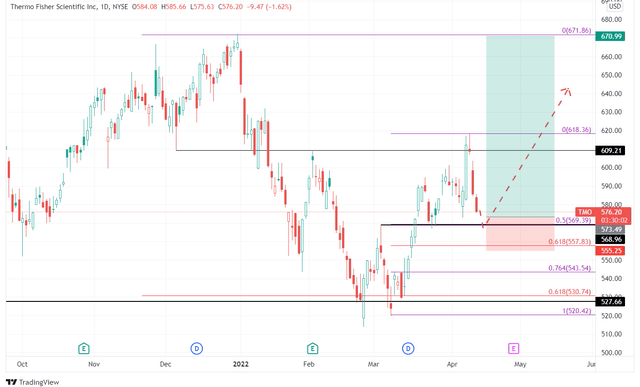

The stock experienced a 20%+ pullback at the start of 2022 and is currently regaining traction. The stock just failed to break the resistance level at around $609. It would be an opportunity if the stock shows signs of reversal at the support at $570, with a Risk to Reward Ratio of 1:5.

TradingView

Conclusion

If you are searching for a healthcare stock that has robust growth and a promising future ahead before an economic recession arrives, TMO would be a strong candidate. It has great previous financial results with EPS 5-year CAGR of over 30%. Covid-related revenue may continue to stay, and the pharma and biotech market is expected to keep expanding. Together with the stock‘s recession-proof ability and the recent momentum in the healthcare sector, TMO makes for an attractive choice.