Christoph Burgstedt/iStock via Getty Images

According to the CDC, Peripheral Arterial Disease (PAD) affects 6.5 million individuals aged 40 and older in the United States. Semler Scientific’s (NASDAQ:SMLR) mission is to develop, manufacture and market innovative products and services that assist customers in evaluating and treating chronic diseases. If you haven’t guessed already, SMLR is aimed at testing for PAD. In this article, I will outline why I own and am buying more of this small-cap medical device business that happens to be…. profitable?

Overview

Semler Scientific is a technology solutions company aimed at improving the clinical efficiency of healthcare providers. Its primary product is QuantaFlo (see image below), which is aimed at diagnosing PAD, a common problem for individuals over the age of 50.

QuantaFlo Product (Semler Annual Report)

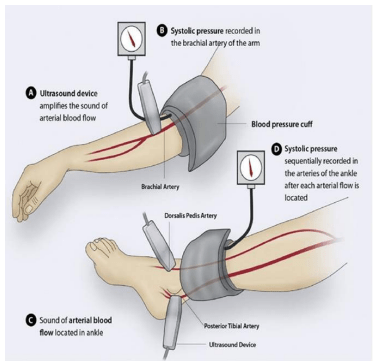

As a four-minute in-office blood flow test with results uploaded in ~5 minutes, the QuantaFlo is a fundamentally better solution to the traditional ABI (Ankle-Brachial Index) test. According to SMLR’s investor presentation, PAD testing has been the same for decades and is a four-step costly process that involves trained technicians and higher-end equipment (see below). Semler reduces the need for high costs and training by providing an accessible product that is able to be utilized quickly with minimal training and knowledge. SMLR states that due to the product’s ease of use, training is generally completed in less than a day either online or in person.

Traditional ABI Test (Semler 2022 Investor Presentation)

In FY’21, Semler introduced two new products to its arsenal via investments in two separate private companies

1. Insulin Insights

An FDA-cleared software product that recommends optimal insulin dosage for diabetic patients in the United States. According to Semler’s research and data, 90% of US diabetics treated with insulin are managed by primary care practitioners, the end-user of Semler’s products.

In SMLR’s Seeking Alpha Q4 Earnings Transcript, Chief Marketing Officer Dennis Rosenburg commented on the new Insulin Insights product:

Insulin Insights is a software program that a healthcare provider can use to optimize outpatient insulin dosing. We previously made an investment in Mellitus Health in October 2020, and in April 2021, we entered into a distribution agreement pursuant to which we prepaid for $2 million of Insulin Insights product licenses. By the end of the fourth quarter, we signed up several customers for this software product. And the service to these customers may begin in the first quarter of 2022.

2. Discern

Discern software is a test for early Alzheimer’s disease. Semler has not yet established a distribution network for this product yet, nor do they have any plans of doing so in the near future.

According to the Q4 SMLR Seeking Alpha Earnings Transcript, CEO Doug Murphy-Chutorian said:

I think that we’re not distributing that product yet. So we have no plans to roll it out very soon… So it’s a very important product, it’s very accurate… So I think we will not talk more about it than that.

Semler distributes its products through both its 85-person sales team and third-party distributors. The table below shows each of SMLR’s products and its distribution network.

| Product | Distributor |

| QuantaFlo | Bard Peripheral Vascular (co-exclusive) |

| Insulin Insights | Mellitus Health (exclusive) |

| Discern | No Distribution Yet |

Revenue Model

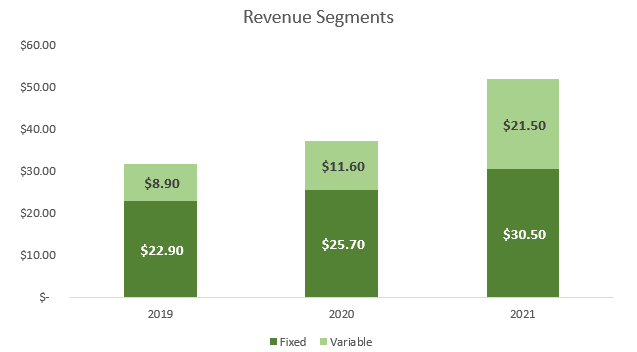

The majority of Semler’s revenue is derived from the sale of its flagship QuantaFlo product and related software sales. SMLR’s two revenue channels include a fixed-fee software licensing model and a variable model fee. It is key to note that Semler does not prioritize profit in the sale of its physical product – rather, SMLR is focused on the software component of the product that drives higher-margin revenue.

The fixed-fee software license model allows customers to pay a fixed dollar amount every month for the product, regardless of how many tests are administered. With the variable fee models, customers pay based on how many tests are administered. As of FY’21 end, 59% of customers were on the fixed-fee plan while the remaining 41% were using the variable fee model based on usage.

Semler Revenue Segmentation (Semler Annual Report 2021)

Semler primarily sells its products to three core customers.

- Health Insurance Plans

- Physician Groups

- Home Risk Assessment Companies

Specifically, Semler’s rationale for selling to health insurance plans is that it results in a win-win type of situation. If PAD can be diagnosed earlier, simple solutions such as “exercising” or “eating healthier” can solve and mitigate the underlying health risk well in advance. Further, Semler’s Investor Presentation states that by preventing PAD from becoming detrimental, there are fewer costs incurred by health insurance companies resulting in favorable economics for both Semler and their customers.

Focusing on Big Problems

Up until 2021, Semler has primarily been a one-product business focusing on its QuantaFlo blood flow test. However, in 2021 Semler expanded the scope of its business and launched its FDA-cleared Insulin Insights software targeting one of America’s largest health problems: diabetes.

Semler’s TAM (total addressable market) is very broad, as PAD and diabetes are extremely prevalent problems in the United States. Based on Semler’s Investor Presentation, it believes over 80 million Americans can be tested for PAD based on AHA (American Heart Association))and ACC (American College of Cardiology) guidelines. The 80 million figure is derived from people who are either 1) aged 65 or older or 2) ages 50-64 with cardiovascular risk factors. While 80 million is quite a high number representing approximately 25% of the American population, it does demonstrate Semler’s product scope and potential reach.

According to Semler’s Annual Report, there are approximately 1.6 million people in the United States with Type 1 diabetes, where insulin use is necessary. Of the 30 million people in the United States with Type 2 diabetes, approximately 21% (6.3 million people) are required to use insulin to reduce blood glucose levels to a healthy range.

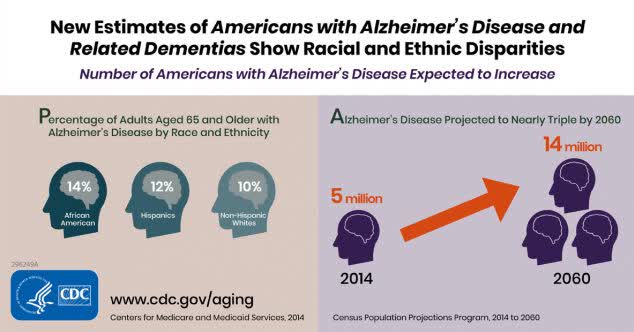

Data from the CDC shows that 5.8 million people in America were living with Alzheimer’s disease in 2020. Further, trends show that the number of people living with the disease doubles every 5 years for individuals older than 65, and 14 million people are expected to live with Alzheimer’s in 2060.

Alzheimers Disease Growth ((CDC))

In summary, Semler’s products are focused on practicality, cost-effectiveness, and accuracy. While Semler’s primary focus has been its QuantaFlo product focused on testing for PAD, its Insulin Insights and Discern products are also tackling massive issues affecting millions of Americans every year. The table and chart below summarize the potential market size for Semler.

| Disease | Semler-Related Products | Total Addressable Market |

| PAD (Peripheral Arterial Disease) | QuantaFlo |

80 million can be tested |

| Diabetes (Type 1 & 2) | Insulin Insights |

7.9 million with diabetes |

| Alzheimer’s | Discern | 5.8 million with Alzheimer’s |

In short, Semler is using proprietary software and testing tools to serve a large group of customers. The problems it is trying to solve (PAD, diabetes, Alzheimer’s) costs the healthcare system billions of dollars each year. Unlike other medical device companies such as DexCom (DXCM), Align Technology (ALGN), and Intuitive Surgical (ISRG) to name a few, SMLR’s QuantaFlo is focused on early detection and prevention rather than solving issues at later stages. The focus on prevention and early testing benefits both the healthcare systems and the lives of individuals that may be suffering from the aforementioned illness.

Competitive Positioning

The Oracle of Omaha, Warren Buffet, is one of the greatest investors of our day and is known for his concept of a “moat”. He says:

A good business is like a strong castle with a deep moat around it. I want sharks in the moat. I want it untouchable.

One of my favorite books of all time is “The Little Book that Builds Wealth” written by Pat Dorsey. In the book, Pat identifies four types of “economic moats” that strong businesses encompass: network effects, low-cost advantages, intangible assets, and switching costs.

As Semler continues to integrate its products and services within more doctors’ offices, switching costs can rise as it would be rather difficult and inefficient to switch to another system. While Semler does not report revenue retention numbers, CMO Dennis Rosenburg said Semler isn’t witnessing any significant churn:

As we talked about in the past, we do not see churn in any significant numbers. And if we see programs, where a small percentage of the machines are not being used, it usually has to do with consolidation on the customer’s part or individual practice is shutting. But we’re not seeing where people are starting PAD testing programs, and then saying, no, this is not making sense for us, we’re going to end that.

As highlighted in the quote above, the only time customer churn is prevalent is in isolated circumstances in which a practice is shutting down. Hence, this confirms the viability and usefulness of Semler’s product.

To further solidify the value proposition of the QuantaFlo, a February 2022 peer-review study was conducted for undetected and asymptomatic PAD amongst 13,971 subjects. 31.6% of subjects tested positive for PAD, and the risk associated included a 60%-70% increased level of all-cause mortality or morbidity at one-year and 40%-50% increased risk at three years. The conclusion of the study further confirmed Semler’s product as useful, indicating it “highlights an enormous potential to realize cost-savings by reducing cardiovascular event rates and deploying population-based PAD risk mitigation strategies”. In short, the fewer cardiovascular events that occur, the better it is for the healthcare system and more importantly, people’s lives.

Semler’s product can be compared to industry disruptors such as Uber (UBER) and Airbnb (ABNB), in that SMLR has truly created a better solution to solving a common problem. While Semler’s business model and industry dynamics are drastically different, common themes exist between SMLR, UBER, and ABNB.

Rather than calling multiple taxi companies or flagging down cabs on the street, Uber allows its riders to simply log onto the app and find a ride within minutes. Whether you call a taxi or an Uber, the destination and end result is the same – at the end of the day, you will get a ride to where you need to go. Instead of searching for different hotels and calling travel agencies, Airbnb aggregates hundreds of places to stay in any given area through its app. Whether you book an Airbnb vs. a hotel, the end result is the exact same – you will find a place to stay for a given period of time at a location of your choosing.

In Semler’s case, rather than getting a referral to go to a trained vascular technician using blood pressure cuffs and doppler ultra-sound imaging, patients can simply attach a clip to both hands and feet to get PAD testing results in five minutes (see the first image of article). While the end result is the same for testing traditionally vs. using the QuantaFlo, the process is different. All three companies have provided a more cost-effective and efficient solution to the underlying problem they are solving within their respective industries. Of course, Semler is unlikely to reach the size of Uber and achieve the scale of ABNB in the near term. Nonetheless, all three companies took an existing method/way of doing something and simplified the process to provide customers with a fundamentally superior solution.

Financials and Share Price

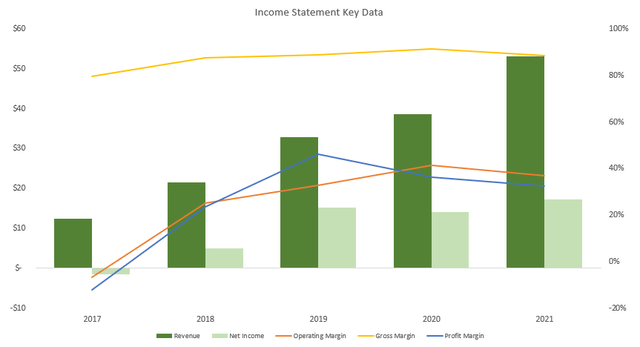

Semler is a small-cap company with a market capitalization of only ~$313 million as of this writing. After missing Q4 earnings estimates by $0.08, SMLR is still a profitable company with strong financials, growing revenue, and high margins. With small-cap companies, seeing high margins, profitability, and cash flow aren’t common. As depicted below, Semler’s top and bottom-line numbers are growing at excellent rates, most recently posting revenue of $53 million and net income at $17.2 million.

Author Created (Semler Annual Reports)

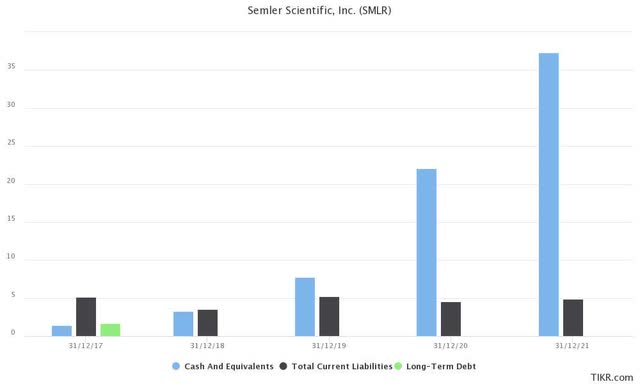

Furthermore, Semler has an impeccable balance sheet with zero debt and $37 million in cash in its most recent fiscal year. As shown below, SMLR is extremely liquid and solvent with almost 9x the amount of cash than the total current liabilities.

Semler Balance Sheet (Tikr)

While the Street is focused on the Q3 and Q4 earnings miss, management said it was due to COVID and a shift in variable fee purchases. Specifically, management noted:

Semler Scientific believes the new pattern in the home-testing market (higher volume of testing earlier in the year) seen in variable fee license (i.e., fee-per-test) revenue is due to a COVID-19 related timing change in the behavior of insurance plans when ordering QuantaFlo® testing from its health risk assessment customers. Notably, in January 2022 compared to December 2021, monthly fixed-fee license revenues increased by approximately 1%, while variable-fee license (i.e., fee-per-test) revenues increased by approximately 87%. Comparing January 2022 to January 2021, monthly fixed-fee license revenues increased by approximately 13%, while variable-fee license revenues increased by approximately 6%. All numbers for January 2022 are preliminary and unaudited.

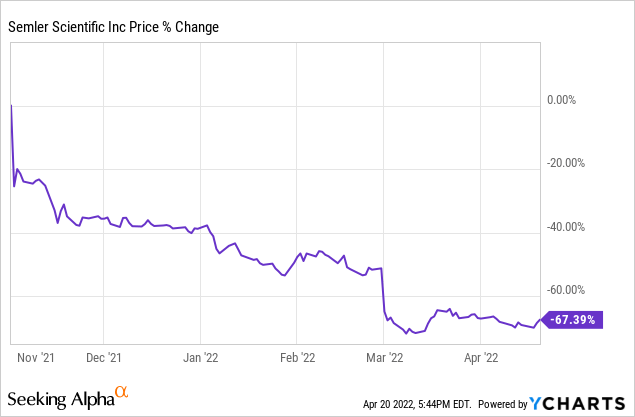

In short, there was a large spike in variable fee revenue in the first half of 2021 resulting in a large decline in the latter half of the year, driving Q3 and Q4 revenue and earnings below analyst expectations. It is important to note that only three Wall Street analysts actually cover the stock. Nevertheless, a couple of bad quarters got the bears a little too excited (see below), with SMLR down 67.39% from its November 1st price post Q3 earnings.

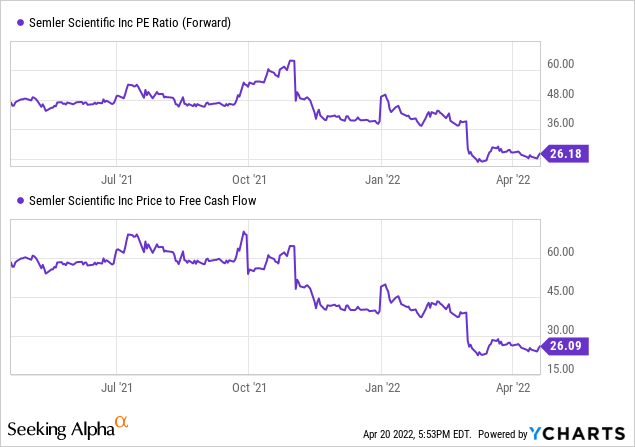

Valuation

As a profitable business, Semler’s valuation is quite reasonable trading at 26x forward earnings and free cash flow. As an up-and-coming medical device company with a focus on high-margin software sales, SMLR seems undervalued based on traditional metrics (see below). However, as mentioned previously, the two quarterly earnings misses have significantly contracted the multiple since November 2021 as the market is not willing to pay as much for the stock.

As long-term investors, a couple of bad earnings reports are not a cause for concern, but rather an opportunity to purchase a great company at a discount. Additionally, the success of Semler’s new Insulin Insights product may determine future investor confidence – something to definitely keep an eye out for in the next few earnings reports as it begins its rollout. Management noted the rollout may start as early as Q1 2022:

We previously made an investment in Mellitus Health in October 2020, and in April 2021, we entered into a distribution agreement pursuant to which we prepaid for $2 million of Insulin Insights product licenses.

By the end of the fourth quarter, we signed up several customers for this software product. And the service to these customers may begin in the first quarter of 2022.

Risks

Concentration

Customer concentration is a very significant risk for Semler. As of F’21, Semler’s largest customer (a large diversified healthcare company) accounted for a whopping 40.8% of the company’s revenue, exhibiting Semler’s reliance on the healthcare company. On a positive note, this customer accounted for 47.2% of sales the following fiscal year, indicative of Semler’s efforts to diversify its customer base and reduce its reliance on one customer.

| 2017 | 2018 | 2019 | 2020 | 2021 |

| 55% | 52.5% | 49.4% | 47.2% | 40.8% |

We can see based on the table above that Semler has made an effort to decrease its customer concentration from 2017to 2021.

Can They Stay Focused?

While Semler’s TAM is undoubtedly large and has room for penetration, Semler must ensure it is able to capitalize on the opportunity. While the launch of its new Insulin Insights product should drive growth in the future and expand its product depth, Semler must continue to focus on its flagship product and ensure organic growth. Semler’s QuantaFlo patent still has five years prior to expiration, therefore it must continue to ramp up sales and marketing efforts to penetrate the market while the threat of new entrants is low. While this is not a significant risk, Semler must remain focused on its flagship QuantaFlo product.

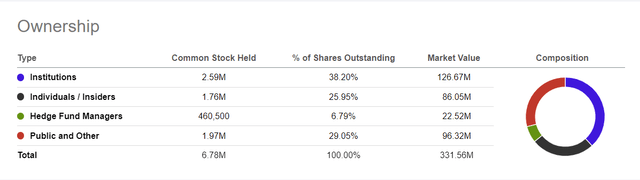

High Institutional Ownership

This isn’t as much risk as it is a warning to investors. With almost 40% of total outstanding shares owned by the “smart money” folks on Wall Street (see chart below), SMLR can be highly volatile and investors should brace themselves for potential short-term volatility. If institutions begin rapidly selling for any reason, the stock can face downward pressure regardless of any change in business fundamentals. Nonetheless, long-term investors shouldn’t worry about short-medium term volatility.

Ownership (Seeking Alpha)

Final Thoughts

All in all, I believe Semler Scientific is a wonderful business to own with significant upside. To recap, the company is:

- Tackling large problems that cost the healthcare system billions each year

- Has created a fundamentally superior solution (patent-protected) compared to traditional PAD testing

- Is expanding its focus into new product lines, most recently Insulin Insights

Due to the recent sell-off since November 2021, I believe the market has presented an opportunity to purchase a piece of this business at a reasonable price. As an investor, I have taken a very small position in SMLR and shareholders should brace themselves for volatility due to high institutional ownership.

Nevertheless, as a long-term investor, seeing SMLR expand its product suite and penetrate a large addressable market is indicative of the company’s growth potential. Factoring in its 67% decline from November, I believe Semler Scientific is a buy at today’s price and offers shareholders room for upside.